Will Murphy

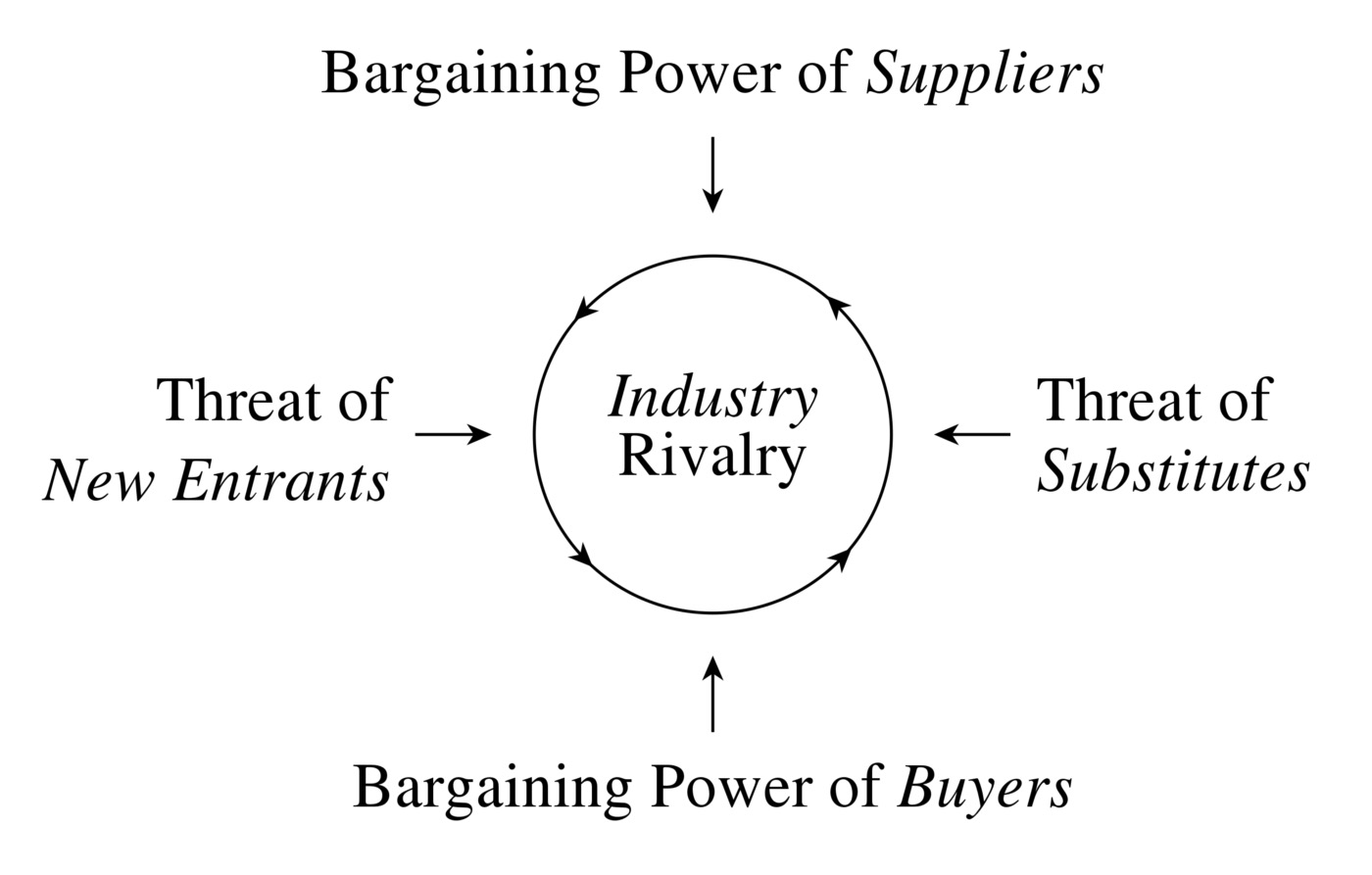

Porter's Five Forces of Data

Porter's Five Forces from Wikipedia

The business strategy of data

Porter’s Five Forces is a great strategic framework. We’ve used it in business strategy for years. If you aren’t familiar, it is a simple framework that helps businesspeople analyze competition within an industry created by Michael Porter. I’ve been fortunate enough to be at lunch with Michael Porter to discuss other matters and he has lots of good ideas. This is his famous and best known business strategy framework, and he has bad lots other interesting ideas as well.

Since deeper descriptions of Porter’s Five Forces are common and ubiquitous, I won’t go deep on defining them here. You can find definitions all over the place, including here.

Porter’s Five Forces can be used for older industries. But, as a product guy, entrepreneur, and innovation enthusiast, I like to use it for emerging industries. Looking at the five forces and speculating about how they will play out can help think about the bigger picture. So, let’s use the Porter’s Five Forces framework on data and A.I. products in general and see what we get. Each of the five forces is listed below with a few thoughts for each.

Bargaining power of the suppliers of data

Where are you getting your data from? Are you purchasing from other companies, are you collecting from customers, or are you collecting from data-sources you own? There is a competitive advantage to owning your data sources. And how good does your data work for AI training?

The market players that control the sources of data will have leverage in this world. Startups can compete, but it’s better to have have a unique way of gathering unique data that the big players can’t access.

The market players that control the sources of data will have leverage in this world.

Note that DaaS (Data as a Service) companies perform just three functions. This is what I call ATD: Acquire, Transform, and Deliver. DaaS companies play a role in the supply chain of data by collecting an introducing data into the ecosystem.

Bargaining power of buyers of data or services based on data

If you are selling raw data, you will have less bargaining power. Unless, you are the market leader and can get better, more comprehensive data cheaper than everyone else. The key is to build insights on other streams of data that others aren’t creating. This will be based on what data you have access to and how good you are at generating insights from the data you have. If you are a data buyer and rely on others to collect data, you will be at a disadvantage unless the data is common and there are a lot of sellers of similar (commoditized) data.

The key is to build insights on other streams of data that others aren’t creating.

As companies rely more and more on data it’s going to become even more important.

Data is more valuable if it can be tied to other data. Data is as useful as the questions it answers for you and your customers. But, in business this is the most obvious value for data. It’s table stakes. I’ve outlined a model for data valuation in a separate post.

Threat of new entrants

This is where the big A.I. players have an advantage. For many areas of A.I. driven products, there are a handful of players that have both a lot of data and the capability to turn this data into products. So, as an A.I. or data entrepreneur, people should beware of stepping into areas where the big guys are playing.

All startups dealing with data and A.I. need to consider what the larger companies may do in their space. The key is to build an A.I. driven product that gathers information as part of using the product. Building your own proprietary data set is the best way to attempt to be a new entrant, and to protect yourself from other new entrants. Be unique, with your own data. And, you might be able to build a product that gathers data simply by being used.

I would also add new DaaS companies with focus on specific data use cases are really interesting here. They are the raw materials providers. There are still startup opportunities for DaaS companies.

Threat of substitutes

This is an interesting area, because this is where A.I. entrepreneurs can look for existing data and look where they can re-purpose it for new industries. One substitute to consider is synthetic data. This is an area I remember brainstorming different opportunities for synthetic data years ago when I was building an AI-driven product and it still seems to be an emerging area in which to build a business.

One substitute to consider is synthetic data.

Synthetic data is data that can be used to train machine learning models without having to got through the process of gathering data from the real world. Companies often spend all their time focusing on their obvious competitors and forget about the threat of substitution. The threat of new substitutes always has a non-zero probability of being a substitute for your product that you never thought about. Or, perhaps opportunities for new product lines you might have missed.

Threat of industry rivals

This is the most obvious threat. I don’t have much to say about this one. This is the obvious one you know. And, it’s the one I spend less time thinking about since from my experience working mainly on innovation strategy, your current direct competitors are often the ones that will pose the least existential threat. And, the other forces I noted above are likely to contain the non-obvious things to think about as you craft your strategy as a data-driven company.